What if I start engaging in professional work in the R.O.C., but only begin meeting the requirements for the tax incentives in subsequent years?

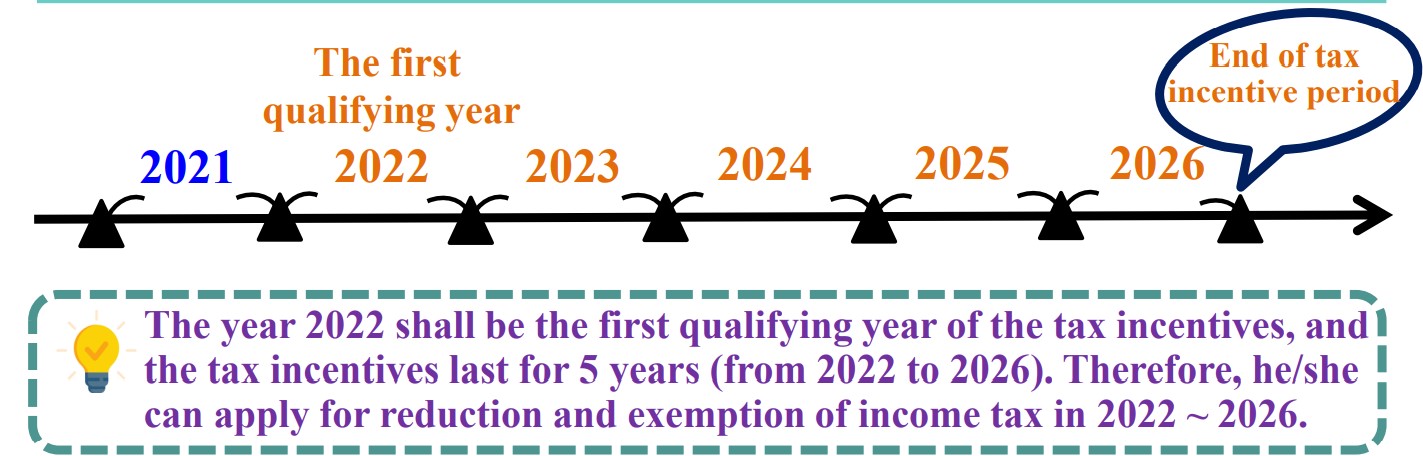

As an example, if you receive the Gold Card in 2021, but you only first meet all the conditions for tax incentives in 2022, then 2022 will be the starting point. You can apply for income tax reductions for a period of five years, ending in 2026.