What is the starting point for the 'five-year' tax incentive period applicable to tax years in which salary income exceeds 3 million NTD?

The five-year period for income tax incentives starts from the first year the Gold Card holder meets all criteria for the tax benefits.

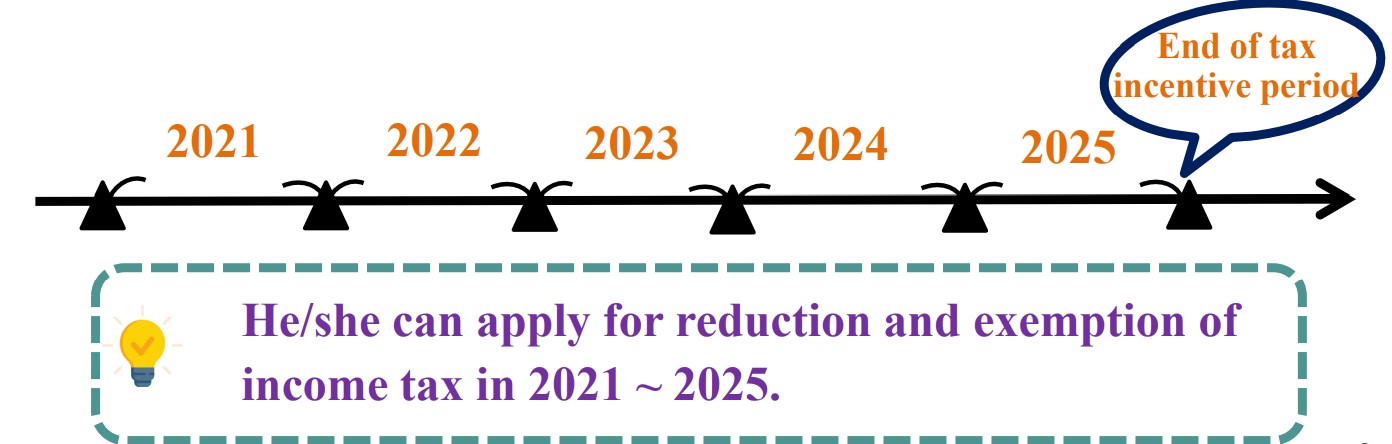

As an example: David obtained his Employment Gold Card in 2021. From 2021 to 2025, he resided in Taiwan for more than 183 days each year, earned a salary exceeding 3 million NTD from professional work, and met other tax incentive requirements. Therefore, the tax incentive period starts from 2021, making him eligible for tax reductions from 2021 to 2025.

Please note: Foreign professionals must still meet specific conditions after obtaining their Gold Card to enjoy tax benefits. Please refer to the relevant regulations for qualification details: Articles 3 of the Regulations Governing Reduction and Exemption of Income Tax of Foreign Specialist Professionals and Article 20 of the Act for the Recruitment and Employment of Foreign Professionals .