Tax

FAQ

Here is a summary of frequently asked questions regarding the Taiwan Employment Gold Card program, the application process, and other general questions regarding life in Taiwan and more.

Please contact the National Taxation Bureau of Taipei, Ministry of Finance .

According to Article 20 of the Act for the Recruitment and Employment of Foreign Professionals , if you meet all the following requirements, you are eligible to apply for tax benefits:

- You have been approved for the first time to reside in the R.O.C. for the purpose of work. (See Note)

- You have engaged in professional work related to the recognized special expertise in the R.O.C.

- During the last 5 years prior to the day of your employment engaged in professional work or the day of obtaining your Employment Gold Card, you did not have household registration in the R.O.C. and were not a resident individual of the R.O.C. in accordance with the Income Tax Act.

Note: You must also stay in Taiwan for at least 183 days within the tax year

Please refer to Article 3 of the Regulations Governing Reduction and Exemption of Income Tax of Foreign Specialist Professionals and Article 20 of the Act for the Recruitment and Employment of Foreign Professionals .

If the overseas company does not have business premises or revenue in Taiwan and only has employee salary expenses, it does not need to file taxes in Taiwan.

For more information, please refer to the Ministry of Finance website .

For a standard overseas company, it is not required to pay taxes in Taiwan. However, if the company distributes dividends and the overseas income exceeds the exemption threshold of NT$7.5 million, personal income tax on the dividends must still be paid. If a foreign national resides in Taiwan for more than 183 days and their overseas company qualifies as a Controlled Foreign Company (CFC) (such as companies in the Cayman Islands, British Virgin Islands, etc.), that company must report business income tax.

If you have any questions about the CFC, please call the Ministry of Finance’s toll-free hotline at 0800-000-321. For more information on the CFC system, please refer to the Ministry of Finance website .

Gold Card holders who meet the conditions for tax incentives should apply to the tax authorities during the annual individual income tax filing period (in May of the year following the income year) or when filing a departure tax return.

The remuneration for services provided while physically in Taiwan is classified as “Income from Sources in the Republic of China (See Note 1)” and is subject to individual income tax. The tax requirements for foreign nationals vary depending on the duration of their stay in Taiwan (See Note 2).

Note 1: For the definition of Income from Sources in the Republic of China, please refer to Article 8 of the Income Tax Act .

Note 2: For details on residency duration and tax requirements, please refer to the National Taxation Bureau’s explanation .

For more details, please review the Instructions for Alien Individual Income Tax . If you have any specific tax questions, please contact the Taxation Bureau .

The National Taxation Bureau begins accepting individual income tax filings in May. If you plan to depart Taiwan before May, please complete your tax filing in advance. The tax filing process varies depending on your employment situation, as detailed below:

Scenario 1: Employer is a Taiwan-based company (with withholding statement) Your employer in Taiwan will provide a withholding statement. Please use this document to complete your tax filing.

Scenario 2: Employer is an individual in Taiwan (no withholding statement) You must provide relevant payment proof, such as remittance records or pay stubs, along with supporting documents like your employment contract.

Scenario 3: Employer is an overseas company For tax filing, prepare documents certified by foreign tax authorities, along with original income documents notarized by a certified foreign accountant or notary public, and a copy of the accountant’s license. If you cannot provide these documents, please submit other documents such as invoices or contracts that verify the source and amount of income.

For information on tax filing, please refer to Tax Resident Status and Related Filing Procedures .

Whether or not a company hires a Gold Card holder does not impact its profit-seeking enterprise income tax. Additionally, any tax benefits for Gold Card holders have no effect on a company’s obligations for this tax.

You may calculate it through the Ministry of Finance’s eTax Portal .

The legal bases for tax incentives for specific foreign professionals are as follows: Articles 3 of the Regulations Governing Reduction and Exemption of Income Tax of Foreign Specialist Professionals and Article 20 of the Act for the Recruitment and Employment of Foreign Professionals.

For Gold Card holders who meet the conditions for tax benefits, for five years counting from the tax year in which they first meet the conditions, half of the part of their salary income above three million NT dollars in each such tax year in which they reside in the State for 183 full days will be excluded from the assessment of individual income tax. Additionally, if in any of those taxable years they receive overseas income classified under Article 12, paragraph 1, subparagraph 1 of the Basic Income Tax Act, that income will also be exempt from being included in the calculation of their basic income for determining the basic tax amount.

Please note: Foreign professionals must still meet specific conditions after obtaining their Gold Card to enjoy tax benefits. Please refer to the relevant regulations for qualification details: Articles 3 of the Regulations Governing Reduction and Exemption of Income Tax of Foreign Specialist Professionals and Article 20 of the Act for the Recruitment and Employment of Foreign Professionals.

Foreign professionals who meet the specified criteria may simultaneously benefit from both incentives.

Source: ‘Scope of Tax Incentives for Foreign Professionals’ (Ministry of Finance Notice No. 09600511820, issued on January 8, 2008, and amended by Notice No. 09804119810 on March 12, 2010).

For criteria and full details, please refer to: Article 20 of the Act for the Recruitment and Employment of Foreign Professionals , The Scope of Application for Tax Preferences Provided to Foreign Professionals , and Articles 3 of the Regulations Governing Reduction and Exemption of Income Tax of Foreign Specialist Professionals

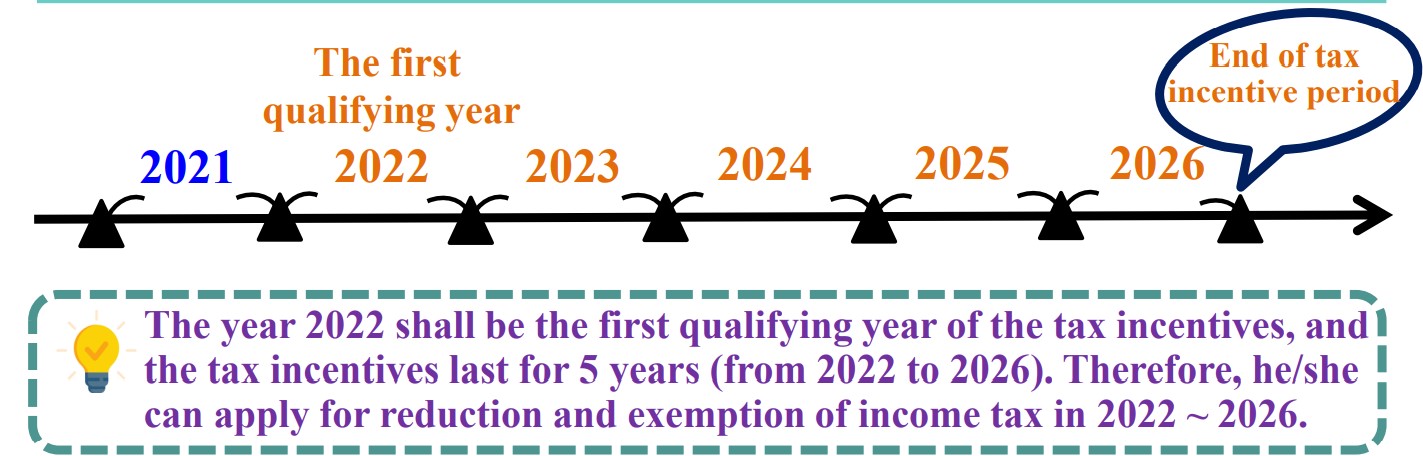

The five-year period for income tax incentives starts from the first year the Gold Card holder meets all criteria for the tax benefits.

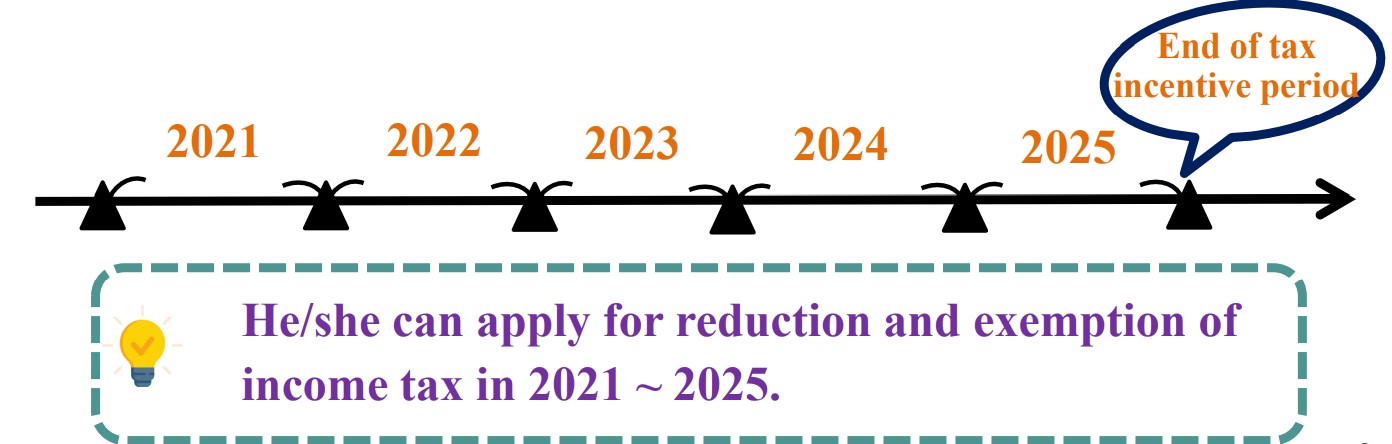

As an example: David obtained his Employment Gold Card in 2021. From 2021 to 2025, he resided in Taiwan for more than 183 days each year, earned a salary exceeding 3 million NTD from professional work, and met other tax incentive requirements. Therefore, the tax incentive period starts from 2021, making him eligible for tax reductions from 2021 to 2025.

Please note: Foreign professionals must still meet specific conditions after obtaining their Gold Card to enjoy tax benefits. Please refer to the relevant regulations for qualification details: Articles 3 of the Regulations Governing Reduction and Exemption of Income Tax of Foreign Specialist Professionals and Article 20 of the Act for the Recruitment and Employment of Foreign Professionals .

If a Gold Card holder meeting the tax benefits requirements obtains the income set forth in subparagraph 1, paragraph 1, Article 12 of the Income Basic Tax Act in such applicable tax year, such income may be excluded from the income basic tax. However, if he/she obtains other kinds of basic income other than overseas income (such as income derived from securities transactions), and the sum of such income and the net taxable income exceeds the threshold of NT$7,500,000 (as of 2024), he/she shall still file the income basic tax return.

In accordance with Article 24 of the Act for the Recruitment and Employment of Foreign Professionals , the provisions apply mutatis mutandis to residents of Hong Kong and Macau areas. In other words, Hong Kong or Macau residents are also eligible to apply for the tax incentives for foreign specialist professionals as regulated by Article 20 of the Act.

Please note: Foreign professionals must still meet specific conditions after obtaining their Gold Card to enjoy tax benefits. Please refer to the relevant regulations for qualification details: Articles 3 of the Regulations Governing Reduction and Exemption of Income Tax of Foreign Specialist Professionals and Article 20 of the Act for the Recruitment and Employment of Foreign Professionals .

- Application Form for Exemption from Income Tax for Foreign specialist professionals (see attached).

- A copy of the Employment Gold Card, which should be the applicant’s first resident certificate approved for work; if it is not the first approval for residence, additional supporting documents should be provided to confirm that previous residence was for reasons other than work (such as a copy of a resident certificate for studies or as a dependent).

- Employment contract and other sufficient supporting documents proving the actual engagement in professional work related to the professional field indicated on the Gold Card.

Dual nationals can apply for income tax reductions. ( Article 20 of the Act for the Recruitment and Employment of Foreign Professionals )

Note: Citizens of the R.O.C. with foreign nationality, who do not hold household registration in the R.O.C. and enter using a foreign passport for professional work or job-seeking, are subject to regulations for foreign professionals. ( Article 25 of the Act for the Recruitment and Employment of Foreign Professional Talent ).

If you were approved to reside in the R.O.C. before obtaining your Gold Card, and that approval was not based on work (for example, if it was for study or as a dependent), then you are exempt from the first-time approval limitation.

This refers to an individual who has no household registration in the R.O.C. and stays less than 183 days within each year (1/1~12/31).

As an example, if you receive the Gold Card in 2021, but you only first meet all the conditions for tax incentives in 2022, then 2022 will be the starting point. You can apply for income tax reductions for a period of five years, ending in 2026.

Domestic Income After Deductions:

Deduction Amount = (8.2 million TWD - Special Salary Deduction of 200,000 TWD - 3 million TWD) * 50% = 2.5 million TWD

Domestic Income After Deductions = 8.2 million TWD - Special Salary Deduction of 200,000 TWD - Deduction Amount of 2.5 million TWD = 5.5 million TWD

Overseas Income After Deductions: Overseas Income After Deductions = 0 (For those who meet the tax incentive criteria, all overseas income is tax-exempt)

Yes, if you disagree with your final assessment, you can apply for a tax recheck. For more information, you can visit the Ministry of Finance web portal

To apply for a tax refund, you can proceed to an inquiry on the Ministry of Finance following portal . For any individual income tax related questions, you can refer to the Ministry of Finance website FAQ .

All Tags

Latest articles

From one month runway to 300% growth - the US/Taiwan startup story of Han Jin & Lucid Han Jin, emigrated to Germany …

2023 Gold Card Community Survey From July to August of 2023, the International Talent Taiwan Office (previously the …

From Student to Permanent Resident: Lakshay Sachdeva’s Remarkable Journey with the Taiwan Gold Card Taiwan, with …

How to apply

Are you convinced that the Taiwan Employment Gold Card will be your personal next step? Amazing - Start with your application now...